Assembly Order Posting to General Ledger

I have previously described how production orders are posting into the general ledger which I have received a lot of positive feedback on. This time I will described how assembly orders are posting into the general ledger in Microsoft Dynamics NAV (which is a lot simpler).

The assembly orders in Microsoft Dynamics NAV was introduced in the 2013 version and they are a great compliment to the production orders, you can read one of my previous blog posts about assembly vs. production orders to get a feeling about what to use when.

The only thing on assembly orders that creates entries in the general ledger is the posting of the assembly order. On production order you can post multiple things multiple times (consumption, output, subcontracting, etc.) but for assembly orders there is only one thing to post which is the completion of a number of assemblies. Posting an assembly order consumes the components, posts the labor in terms of resources (if any) and outputs the assembly item.

Below is an example of how it works and what gets posted into the general ledger on what account.

Setup of Assembly Item

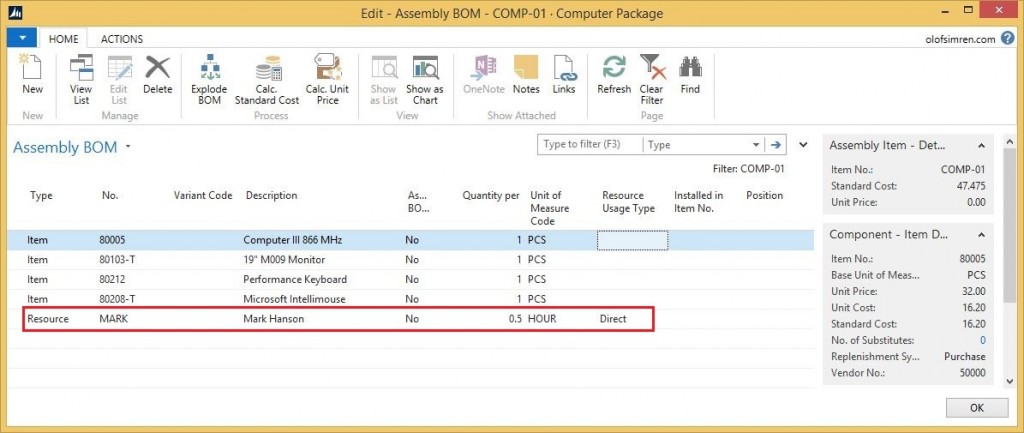

In this example I will use the same computer package as described in the blog post about assembly orders with inventory picks and movements. To spice things up a bit I have added a resource to the assembly BOM according to below. The resource will be used to add some labor cost to the assembly.

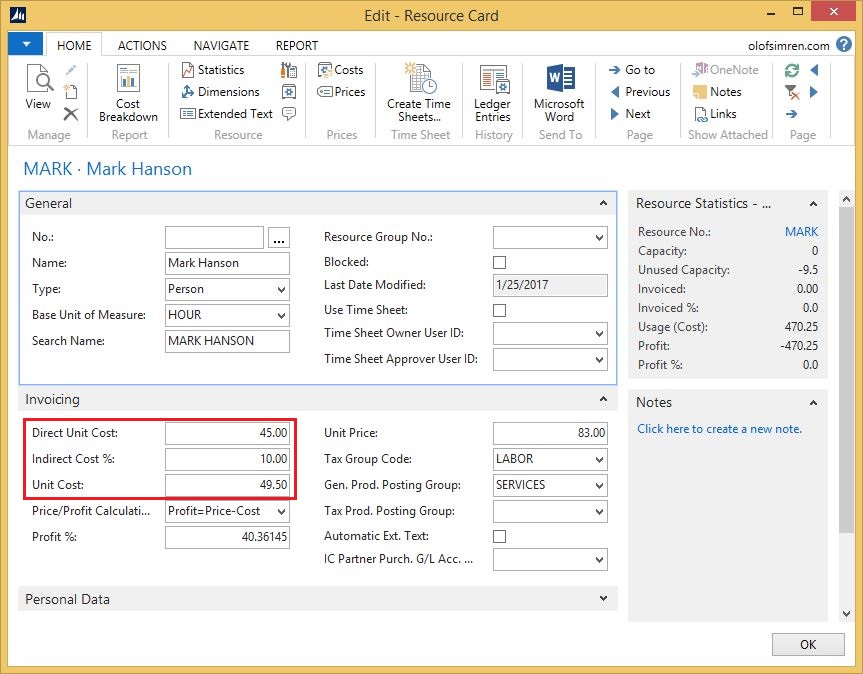

The resource added has a direst unit cost of 45 and an indirect cost of 10 % (kind of similar to the setup you have on a work center card).

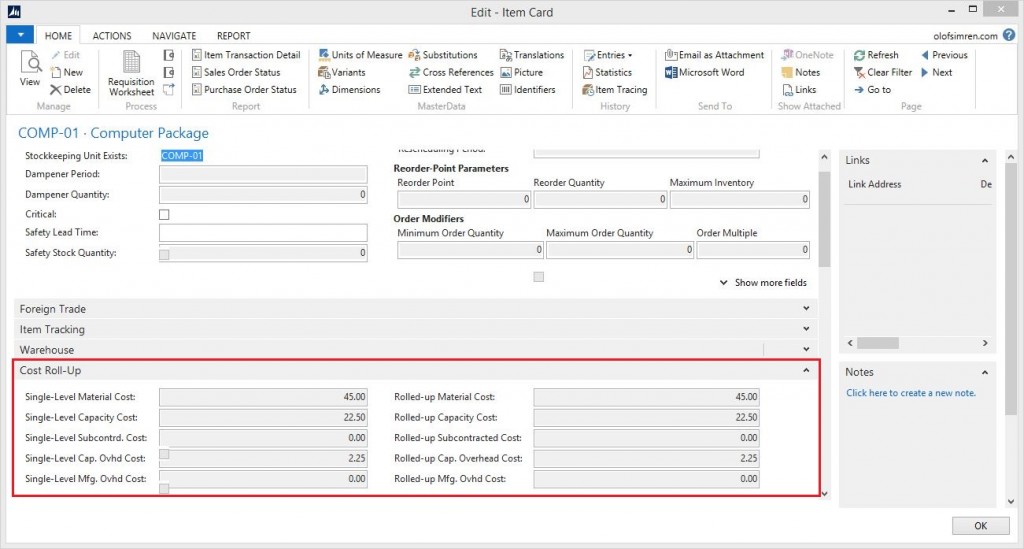

The item being assembled is in this case setup with the standard costing method, and a cost roll has been performed when the item was created (just like you would do with a regular manufactured item). The fields on the item card (described in a previous blog post; cost roll-up details on the item card) looks like below. Note that the costs of the resource in the assemble BOM gets roll-up in the capacity cost fields.

Also note the resource usage type option in the assembly BOM, if this is set to direct then the hours is per unit produced, if this is set to fixed then it is per assembly order (like run time vs. setup time on production orders). So if you set it to fixed you need to populate the lot size field on the item card to get a proper standard cost roll-up where the cost of the capacity is allocated towards a certain quantity (the same way as you would do for setup costs on items that are produced using production orders).

The Assembly Order

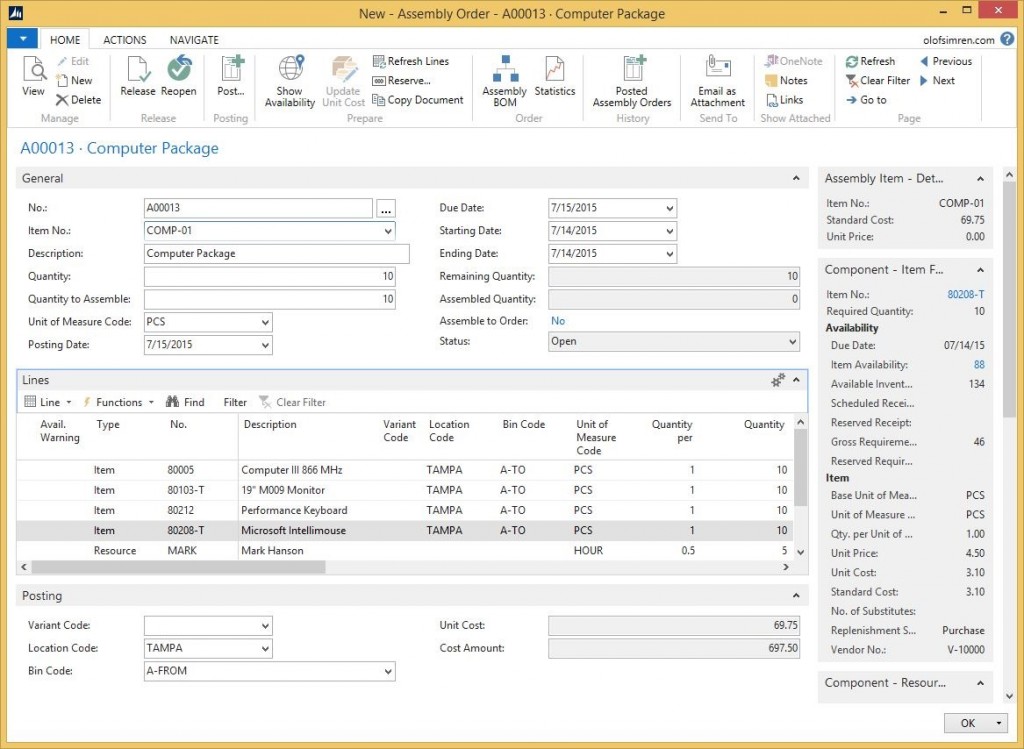

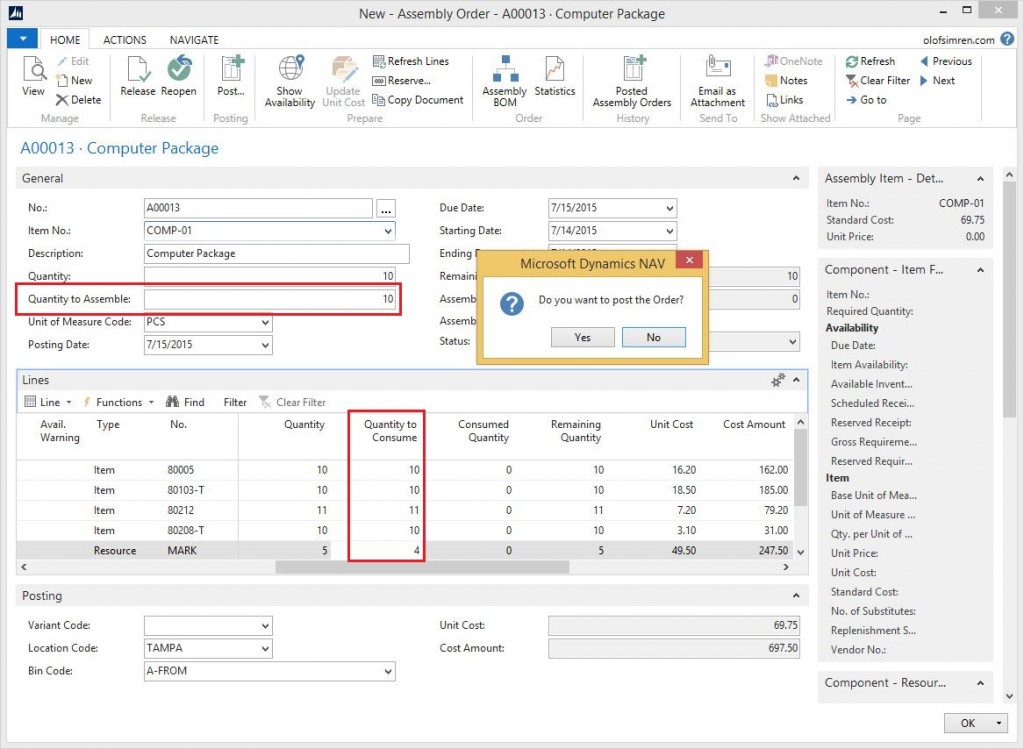

The example will use an assembly order for 10 pcs of the computer package according to below.

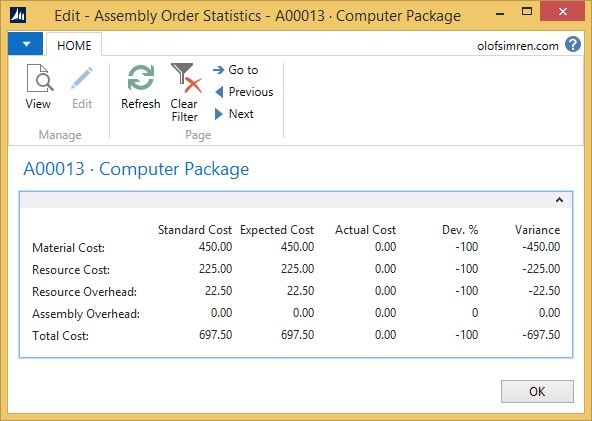

An assembly order has a statistic page that shows the cost breakdown where the standard cost comes from the fields on the item card, the expected costs comes from the assembly order lines and the actual costs comes from the transactions posted against the order (just like production orders).

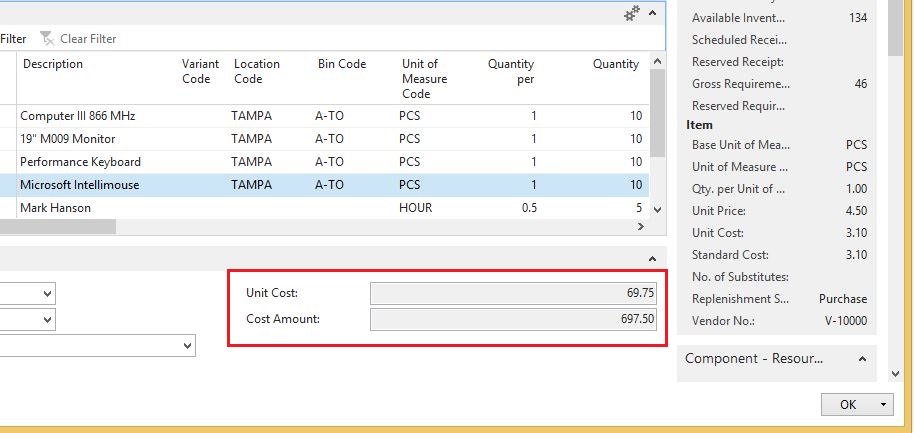

In addition to the statistics page is the unit cost field on the invoicing tab (and a cost amount which is the unit cost multiplied with the quantity). If the assembly item is a standard cost item then this unit cost is the standard cost from the item card, if the assembly item not a standard cost item then this unit cost is the sum of the costs of the components (and it gets updated automatically if components are changed).

Posting the Assembly Order

Now we post the assembly order; this consumes components and resources according to the quantity to consume on the assembly order line and outputs the quantity according to the quantity to assemble in the header of the assembly order. In this case I have slightly changed the quantities to consume on the lines; I am telling NAV that I have consumed 11 pcs instead of 10 for one of the components and instead of the assembly taking 5 hours it was done in 4 hours (this way I should get a variance posted into the P&L).

When an assembly order has been posted it becomes a posted assembly order. Make sense. 🙂 And if the remaining quantity is 0 the original assembly order is deleted.

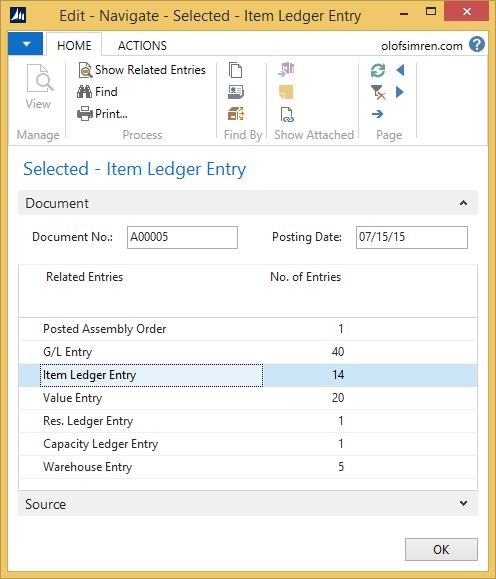

If we navigate on the posted assembly order we see all the transaction that was created during the posting (just like on any other posted document in NAV).

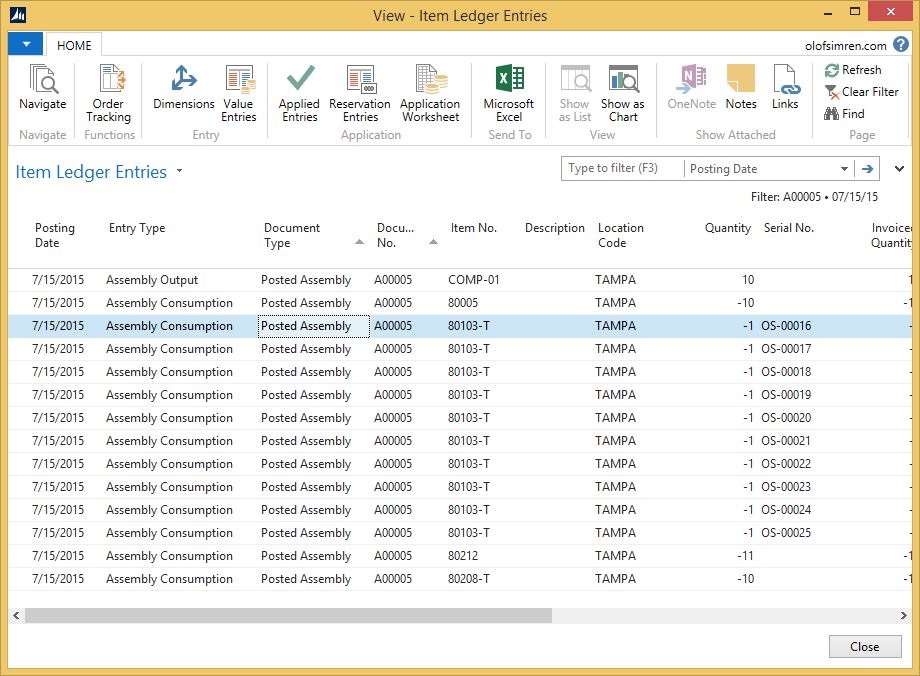

If we first look at the item ledger entries we see that there is an assembly output for the assembly part and assembly consumptions for the components.

Note that one of the items where serial number tracked, and as you might know the serial numbers are on the item ledger entries so you get one transaction per serial number.

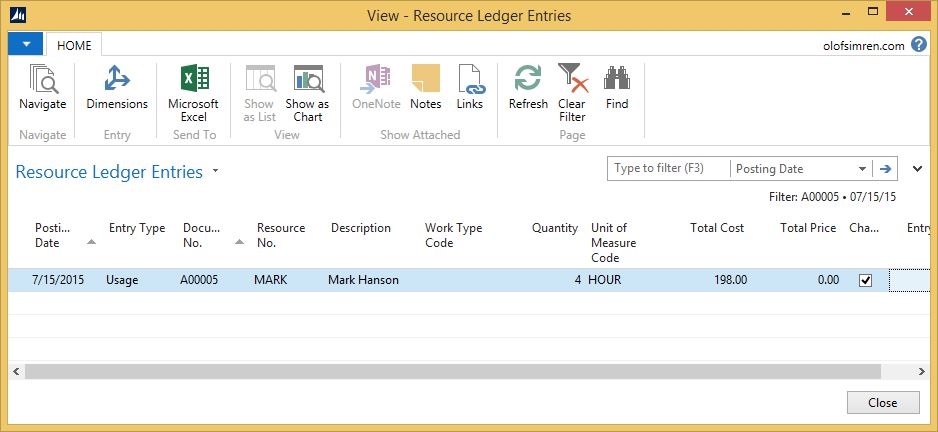

We also get a resource ledger entry for the resource that was on the assembly order. In this case 4 hours for a total cost of 198.

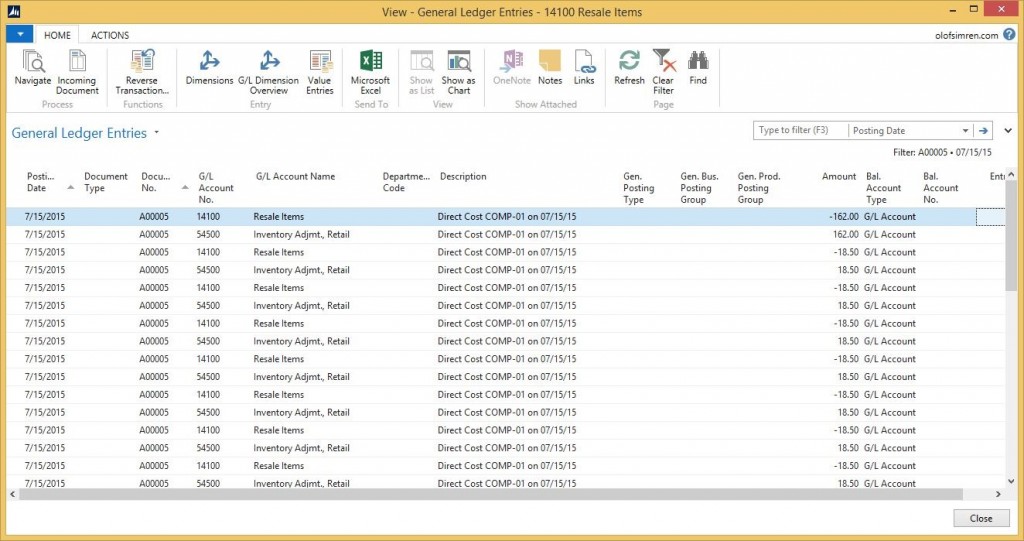

And the general ledger entries (which was the main purpose of this blog post) turns out as below.

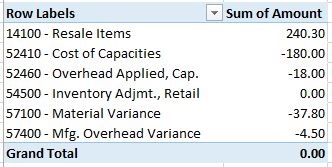

In this case it created 40 general ledger entries (using serial number multiples the number of general ledger entries as well since there are two g/l entries per value entry). To get a better view of the net changes in the general ledger we can export the g/l entries to Excel and do a pivot table (the same was as described here; production order posting to general ledger).

Consumption of Components

For the consumption; the inventory account is credited according to the cost of the component consumed, and the debit side of this transaction goes to the inventory adjustment account in the P&L. The inventory account is defined in the inventory posting setup and the inventory adjustment account is defined in the general posting setup (based on the posting groups of the component). Kind of the same as a negative inventory adjustment actually.

Resource Costs

For the resource cost; NAV credits the cost of capacity account and debits the inventory adjustment account for the direct cost and for the indirect cost it credits the overhead applied account and debits the inventory adjustment account (all P&L accounts, no WIP in the balance sheet to increase as it would have been with a production order). All of the accounts comes from the general posting setup of the posting group defined on the resource card (direct cost applied account, overhead applied account and inventory adjustment account). The amounts are the costs on the resource card multiplied with the quantity posted.

Output of Assemblies

For the output; NAV debits the inventory account in the balance sheet and credit the inventory adjustment account in the P&L. The amount is the sum of the posted inventory and resource costs. If the item is a standard cost item (like in our case) you might also get some variances posted into the P&L (if there is a difference between the standard and actual costs). The variance accounts comes from the inventory posting setup for the posting group defined on the assembly item and the balancing account for the variances is the inventory account (which makes the inventory value in the balance sheet match the standard cost).

That’s it related to what general ledger accounts that are used during an assembly order posting.

Dimensions on Assembly Orders

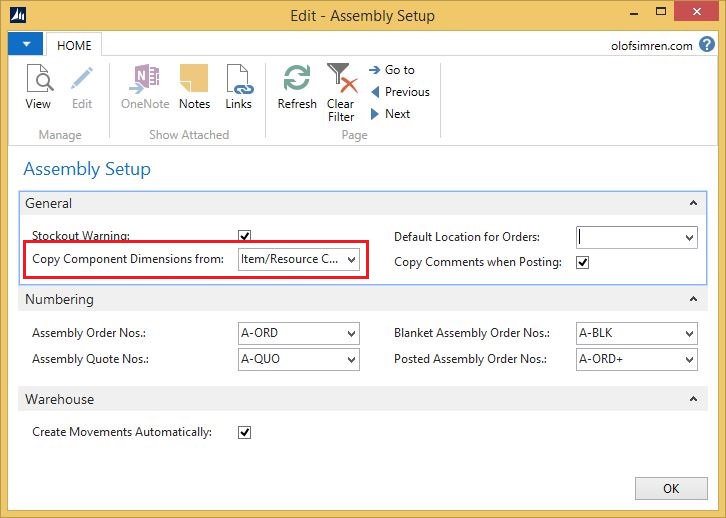

Some of you might wonder about what dimensions that are being used. If you have read my earlier blog post related to dimensions on production orders you know that on production orders the consumption of the components gets the dimensions of the output item (which might not always is the preferred, luckily this is easy to change, see default dimension priorities for production order components). So how does it work on assembly orders? Well, here Microsoft has been smart enough to give us the option to choose through a setup called ‘copy components dimensions from’ in the assembly setup table. It is either from the items/resources or from the header of the assembly order.

Hats off for Microsoft for this option! 🙂 My bet is that we will see this option soon in the manufacturing setup table as well, would make a lot of sense and eliminate a common modification.

That’s all, remember to share this post using share button below to the right (I know it is almost invisible :-)).

2 Comments

Leave your reply.